Last month, I took a look at @flyingtulip_'s PPT and thought about it. I don't think it's a good opportunity, mainly concerned about the redemption and this person AC.

The model has been explained by @Wuhuoqiu, previously it was said to be 500 million institutions and 500 million retail investors, now with 200 million institutions, it shows that large institutions are not very interested in it. I don't know how much the participating institutions have invested or what they think of this project; maybe it's just an investment commitment.

If we set aside AC for this assumption, if 200 million from institutions has been invested, and the public offering has gradually raised 800 million, putting 1 billion into the treasury through a safe method to earn a 5% annualized return, the annual income would be 50M. Some of the income would flow to the team, and some would go to buy back tokens. Because of these buyback tokens, the price will rise. The ideal situation would be to have over 1 billion in funds stored in the treasury, but personally, I think that's impossible.

Possible scenarios for the public offering:

In a normal situation, 200 million from institutions enters the treasury, and the public offering quickly raises 800 million.

In a worse situation, some institutions give up on investing, and the public offering can't reach 800 million and has to start early.

In the worst-case scenario, learning while doing, the treasury/protocol gets hacked, and not only the interest but the principal is gone.

What will the actual situation be like?

Redemption queues, referencing the redemption wave at the end of October from @zerobasezk. If there are significant changes in the protocol due to large redemptions, will the annual income of the protocol not meet the expected 50M? If it doesn't reach 50M, how can it support the token's expectations?

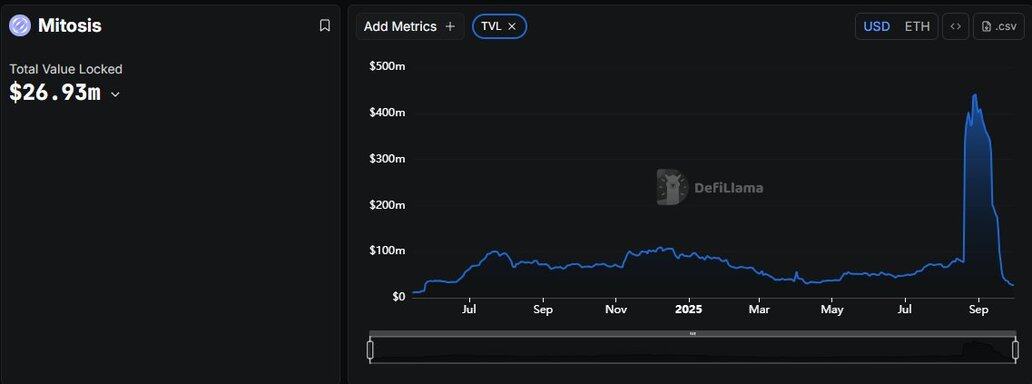

In fact, it's a project valued at 40M, and they insist on treating TVL as financing. I don't know what tricks they are playing, fearing that a project valued at 40M won't attract that much TVL?

The remaining concern is about AC. This project involves so many directions of protocols, and actually, the one in the middle should be valued at more than 1 billion. More and comprehensive does not mean it will be exquisite; wanting everything means getting nothing. Even Ethena's mechanism was first questioned and then understood during its maturity... AC is no longer the AC of the past.

The funds from Flying Tulip will go to Sonic. What is Sonic? Victims of the cross-chain bridge's bad debts can't recover those funds now, as they have been wiped out by the public chain's currency exchange.

"The bad debts of the Sonic cross-chain bridge mainly stem from the Multichain protocol hack incident in July 2023, with total losses of 210 million USD, of which Sonic Labs lost about 122 million USD."

In summary, it's a game of schemes, and the leader AC is not very reliable. In fact, this scheme can be initiated on any chain with Aave, and I even think this scheme would be better on Plasma, with a 15% APR being more appealing than 5%. If raising that much seems difficult, then set a cap of 100 million with no VC community fund, a 10M valuation airdrop token model, faster, better, and higher.

The above content is only a market analysis made for personal learning and research, and does not constitute any investment advice or official position of the project.

Earlier examples reference

24.81K

137

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.