How to borrow $10M with just $100…

And make serious profits without paying a cent in interest.

(A thread on Flash Loans) 👇

Here’s the traditional way to make profit with loans:

- Have substantial collateral

- Get loan

- Use loan make profit as if it was your capital

- Return loan

- Pay interest

- Takes weeks

But in crypto it looks like this:

- have zero any amount in collateral

- Get loan

- Use loan to make profit

- Repays loans immediately

But how “immediate” it is returned depends on the type of transaction. I’ll explain:

A Flashloan is an uncollateralized loan that must be borrowed and repaid within the same blockchain transaction.

If the loan isn't repaid within that single transaction, the entire transaction is reversed, making them risk-free for lenders.

To perfectly utilize this tool you must understand the 2 types of transactions to apply it:

1. Short-Term: Arbitrage, profit-driven liquidations, funding arbitrage

2. Long-Term: Collateral swaps, self-protection liquidations, leveraged looping, leverage yield farming

I’ll only explain the important ones

Here’s an explanation with examples of how each work:

1. Arbitrage:

Borrow → exploit a price difference between exchanges → repay instantly → keep the profit.

Example:

• On Exchange A, ETH = $1,000

•On Exchange B, ETH = $1,010

•You take a flashloan of 1,000 ETH ($1M).

•Instantly buy ETH on Exchange A ($1M worth).

•Sell ETH on Exchange B for $1.01M.

•Repay the flashloan ($1M + small fee).

•Profit = $10K in seconds

2. Liquidations (profit-taking):

Use flashloan liquidity to liquidate someone else’s under-collateralized position and collect the liquidation bonus.

Example:

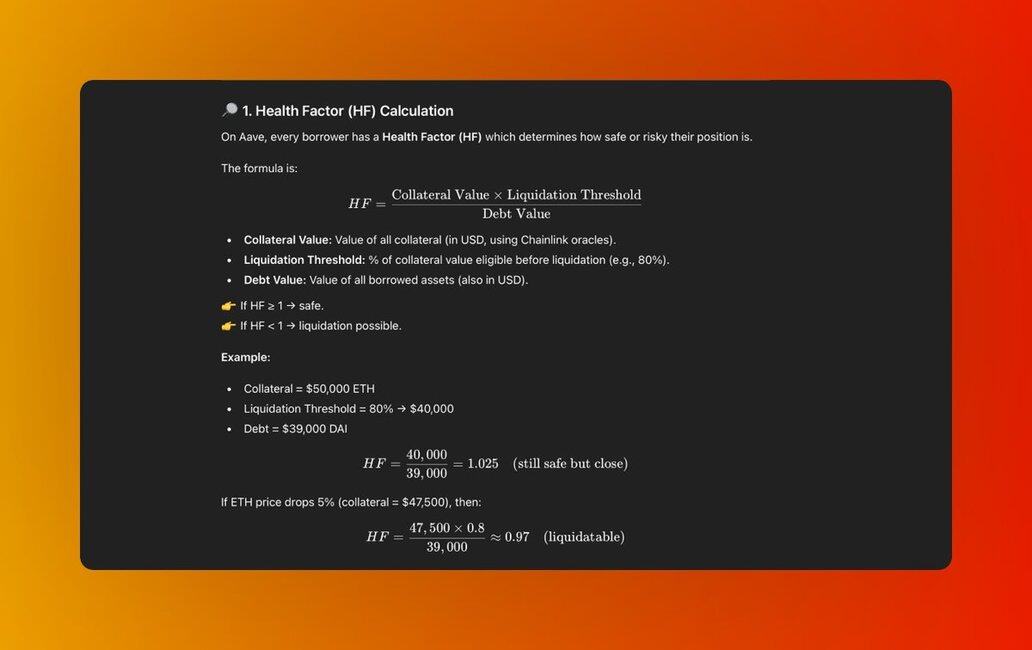

• Borrower on Aave has collateral worth $50K in ETH but debt of 40,000 DAI close to liquidation i.e health factor < 1

•A flashloan allows you to borrow 20,000 DAI (liquidating them) → repay their debt → seize their ETH at a discount

•Repay the flashloan instantly (swap the ETH Aave gives for dai to repay)

•Profit = liquidation bonus (e.g., $2K in ETH)

3. Leverage looping:

In a nutshell, looping involves:

• Lending or depositing some capital (e.g. ETH into Aave)

• Borrowing another currency (e.g. DAI) against it

• Swapping the borrowed amount for the original asset (ETH)

Example:

- Deposit 1 ETH

- Borrow 825 DAI

- Swap 825 DAI for 0.825 ETH

- Lend 0.825 ETH

Total ETH exposure: 1.825 ETH

This picture involves looping with 115 ETH as collateral taking a 400 ETH flashloan position to borrow 450k USDC when ETH was at $1580

400 - 115 = 285 (450k USDC at $1580)

When ETH at $1680 (only 268 ETH needed to pay 450k loan)

Therefore, 285 - 268 = 17 ETH profit after repaying 450k loan

Thereby making a 17 ETH when ETH came to $1680

Based on the 3rd explanation, Flashloans for leverage are now obsolete what with the rise of perp DEXs

I can just open a 3.5x long instead of leverage looping

Saves time and effort of calculations

Therefore, the likelihood of making money with a flashloans is now obsolete

In my next thread I’ll explain other practical applications of flashloans using @plumenetwork and @useteller

This thread is proof that people see what they want to see

And read what they want to read

There’s nothing like profits from flashloans

Although a basic understanding of it can help you build strategies in other applications

Making money with it is not aa easy anymore

27.46K

290

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.