$FF (bearing) vs. $EDEN (bullish) – my thesis ↓

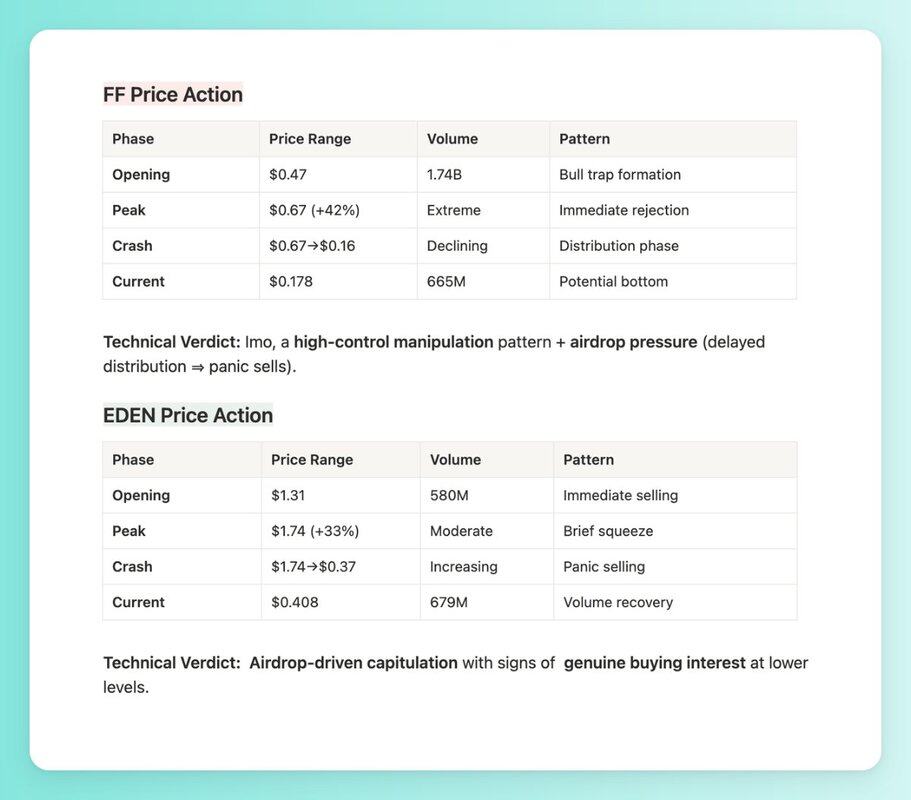

Both $FF and $EDEN experienced heavy post-TGE sell-offs with 70%+ declines, yet my outlook differs significantly.

Critical difference is the valuation.

• @FalconStable FDV: $1.79B (completely detached from reality)

• @OpenEden_X FDV: $408M (reasonable for RWA sector)

FF is trading at 4.4x EDEN's valuation despite having weaker fundamentals. This valuation gap is the primary reason for my different outlooks.

$EDEN's launch structure was much better.

• Smaller FDV & circ supply → Easier to absorb selling pressure

• Real business model: Actual revenue from RWA products

• Regulatory compliance: Licensed operations reduce regulatory risk

Long-term, $FF's success depends on $USDf adoption, which requires:

• User trust in synthetic mechanisms

• Competitive yields vs traditional stablecoins

• Regulatory acceptance of synthetic dollars

All of these are uncertain.

The important part here is that $EDEN has proven revenue streams – while $FF has no:

• TBILL fund management fees

• USDO stablecoin operations

• RWA tokenization services

These generate real cash flow.

Recovery catalysts for $EDEN:

• Fundamental value support at current levels

• Institutional adoption pipeline

• TVL growth momentum

• Token utility development potential

• Sector rotation into RWA tokens

My price targets for the $EDEN position ↓

• Bear Case: $0.30-$0.40 (limited downside)

• Base Case: $0.60-$1.00 (fair value recovery)

• Bull Case: $1.50-$2.50 (growth premium)

Hodling $EDEN.

NFA ofc, I agree if you disagree.

Show original

21.7K

117

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.