Barter Alpha #7: The week of DeFi from peaks to rugs

<> Barter ATH

<> Stablecoin Supernova

<> The $20B potential

<> New perp king

<> Another ghost protocol

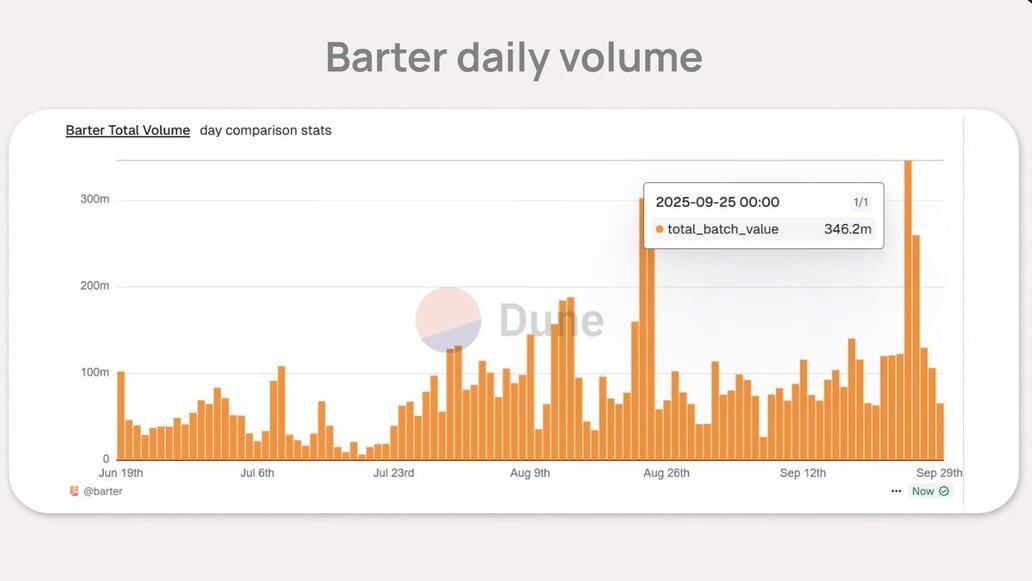

@BarterDeFi hit new ATH in daily volume

<> $346.2M routed by Barter just in one day.

@Plasma’s mainnet launch is turning into one of the most aggressive Layer 1 debuts DeFi has seen

<> In just two days, stablecoin supply on Plasma passed $7B;

<> Aave’s Plasma market hit $6.5B deposits;

<> The $XPL hyperp flipped to a regular perp: traders can now long/short with 10x leverage;

<> $XPL is already up +30% since launch, trading at a $12B FDV. Seed round investors are sitting on a 324x return, though most are locked for 12 months.

Plasma’s growth is fueled by token incentives and its key pitch: zero-fee $USDT transfers.

SoftBank and Ark Investment are reportedly in talks to back Tether in a potential $20B funding round at a $500B valuation

<> Would make Tether one of the most valuable private companies ever, rivaling OpenAI and SpaceX;

<> Cantor Fitzgerald advising; SoftBank, Ark, and Tether already partners in Bitcoin treasury firm Twenty One Capital;

<> USDT supply hits $173B; U.S. stablecoin launch plans also in motion.

@Aster_DEX just climbed to the #1 spot in daily fees and volume among perpetual DEXs

<> $28M in fees in 24h, $85B in 24h volume, leaving Hyperliquid and Lighter far behind.

2.62K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.